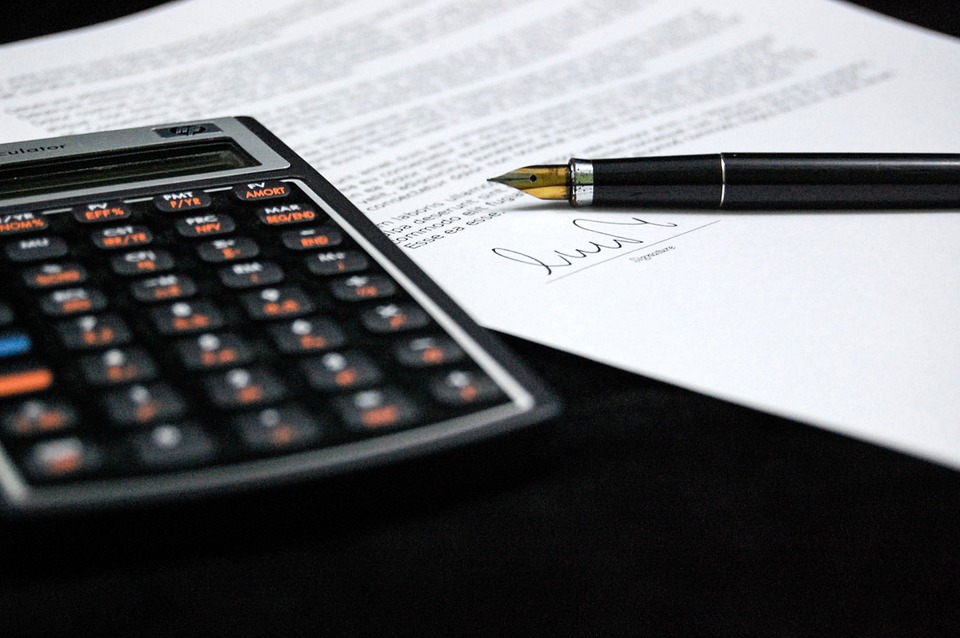

Due diligence is a process for evaluating the risks associated with a business opportunity. It is an objective means of assessing the possible pitfalls in conducting business with an individual or company. It involves reviewing business records and legal filings as well as examining the individuals involved with the business (especially with regard to the ultimate beneficial owners).

In the wake of the Panama Papers scandal and increasingly strict regulatory requirements for conducting business with international companies and individuals, it is more important than ever to conduct thorough due diligence on prospective business partners. International due diligence companies can help to make this process significantly easier because they have extensive local knowledge, databases and company search facilities in the target country that the prospective entity operates.

There are no specific legal requirements that cover the process of undertaking due diligence. Companies should, at the very least, take the following steps in investigating a prospective international business partner.

1. Create a comprehensive questionnaire that elicits the information required to perform a risk analysis

2. Verify the information provided using a risk-based approach and independently verify that the information is correct

3. Ask for additional information or make risk judgments based on the information provided and verification undertaken

Using the information provided in the questionnaire, companies should conduct thorough background research to provide a comprehensive risk assessment, particularly in regard to any red flags or other significant issues that have arisen from the information provided by the target.

International due diligence companies can be particularly valuable in assessing issues. Such companies often have access to local information from sources that are otherwise unavailable to foreign companies including local networks of business people. These companies can facilitate local record searches and to confirm the potential business partner’s background and reputation. It is also important to seek a wide range of opinions in order to ensure independence in the information provided.

Conducting thorough due diligence on a prospective business partner has the following benefits:

. Helps a company to evaluate the strengths and vulnerabilities of a prospective business partner

. Provides the most detailed and up-to-date business and financial data

. Verifies claims made about their assets and finances as well as substantiating their reputation in the local marketplace

. Helps to avoid risks that can result in lawsuits or regulatory sanctions that result from having incomplete knowledge of the individuals, subsidiaries or other corporate entities that ultimately control the enterprise

. Identifies gaps in knowledge that need to be filled before a thorough risk assessment can be made

Performing proper due diligence on an overseas company can mean the difference between a successful partnership and one that can cost a company significant time, money and reputation as well as the possibility of fines and other sanctions.